Introduction

Harshad mehta bull run rajkotupdates news : a term that resonates with financial enthusiasts and investors, left an indelible mark on India’s stock market history. While the primary epicenter of this financial whirlwind was Mumbai, its ripples were felt across the nation,

including in Rajkot, a significant financial hub in Gujarat. In this article, we will explore the impact of the Harshad Mehta Bull Run on Rajkot and provide updates on its long-term consequences.

Also read : https:/windows-11-rajkotupdates-news-know-all-about-2/

-

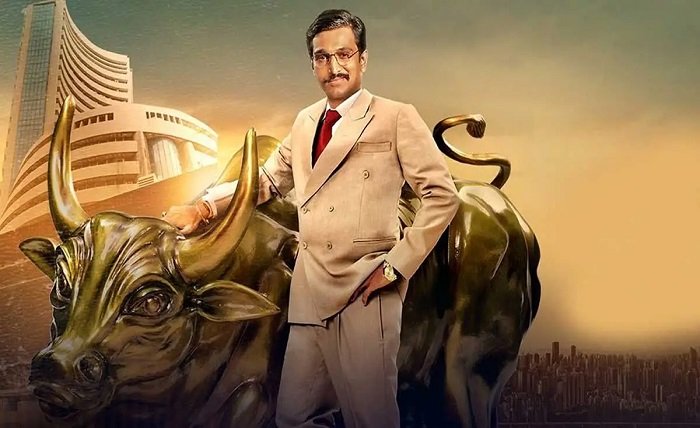

The Harshad Mehta Bull Run: A Brief Overview

The Harshad Mehta Bull Run, also known as the ‘Big Bull’ phenomenon, refers to a period in the early 1990s when stock prices in India skyrocketed due to various factors, primarily orchestrated by Harshad Mehta, a prominent stockbroker. Mehta manipulated the stock market by exploiting loopholes in the banking system and engaging in a process known as ‘stock price rigging.’ This led to a massive bull market, characterized by a rapid surge in stock prices.

-

Rajkot’s Connection to the Bull Run

Rajkot, a bustling city in Gujarat, has a rich history of financial activity. Harshad mehta bull run rajkotupdates news :During the Harshad Mehta Bull Run, it was not immune to the excitement and frenzy gripping the nation’s stock markets. Investors in Rajkot, like their counterparts across the country, saw their portfolios swell as stock prices soared.

-

The Aftermath: Lessons and Repercussions

As the Harshad Mehta Bull Run reached its zenith, it became evident that it was built on a shaky foundation. The subsequent crash left countless investors in financial ruin, including those in Rajkot. The stock market crash of 1992 exposed the vulnerabilities in India’s financial system and prompted regulatory reforms.

-

Regulatory Reforms and Rajkot’s Financial Landscape

In the wake of the Harshad Mehta scam, India’s financial sector underwent significant regulatory changes. Institutions like the Securities and Exchange Board of India (SEBI) were established to ensure transparency and accountability in the stock market. These reforms also influenced financial activities in Rajkot, making it a safer place for investors.

-

Rajkot’s Post-Bull Run Economic Growth

Harshad mehta bull run rajkotupdates news :After the initial shock of the Harshad Mehta Bull Run and its subsequent collapse, Rajkot, like many other cities, embarked on a journey of economic recovery. The city diversified its economic activities, including bolstering its manufacturing sector and attracting investment in infrastructure development. Rajkot’s resilience played a pivotal role in its economic revival.

-

The Modern Rajkot Financial Scene

Today, Rajkot has emerged as a prominent financial center in Gujarat. Its stock exchanges and financial institutions have adopted modern practices and technologies to ensure a secure and efficient financial environment. Investors in Rajkot now benefit from a more robust regulatory framework and greater transparency.

-

Lessons Learned from the Bull Run

The Harshad Mehta Bull Run left a lasting legacy, serving as a cautionary tale for investors and regulators alike. Some key lessons that emerged from this episode include:

a. Regulatory Vigilance: The importance of robust regulatory oversight cannot be overstated. SEBI and other regulatory bodies play a critical role in safeguarding the integrity of India’s financial markets.

b. Risk Management: Investors learned the importance of diversifying their portfolios and practicing risk management to mitigate potential losses.

c. Transparency and Accountability: The need for transparency and accountability in Harshad mehta bull run rajkotupdates news :financial transactions became evident, leading to the adoption of modern technologies and practices.

d. Long-Term Perspective: Investors in Rajkot and elsewhere now emphasize long-term investment strategies rather than quick gains.

Conclusion

Harshad mehta bull run rajkotupdates news :was a watershed moment in India’s financial history, and its effects were felt even in cities like Rajkot. While the initial euphoria gave way to a harsh reality, the lessons learned from this episode have shaped the financial landscape for the better.

Today, Rajkot stands as a testament to resilience and adaptability in the face of financial turbulence, offering a secure and promising environment for investors. The Harshad Mehta Bull Run may be a distant memory, but its legacy endures in the form of a more robust and accountable financial system in Rajkot and across India.

FAQ

1. What was the Harshad Mehta Bull Run, and how did it impact Rajkot’s financial landscape?

The Harshad Mehta Bull Run was a period in the early 1990s characterized by a massive surge in stock prices orchestrated by stockbroker Harshad Mehta. It had a significant impact on Rajkot’s financial landscape, as investors in the city, like the rest of India, saw their portfolios swell during this time.

2. What were the long-term repercussions of the Harshad Mehta Bull Run on Rajkot?

The aftermath of the Harshad Mehta Bull Run led to regulatory reforms in India’s financial sector, including the establishment of institutions like SEBI. These reforms influenced Rajkot’s financial landscape, making it a safer place for investors and paving the way for long-term economic growth in the city.

3. How has Rajkot’s financial scene evolved since the Bull Run?

Rajkot has emerged as a prominent financial center in Gujarat. Harshad mehta bull run rajkotupdates news : Its financial institutions have adopted modern practices and technologies to ensure a secure and efficient financial environment. Investors in Rajkot now benefit from a more robust regulatory framework and greater transparency.

4. What are the key lessons learned from the Harshad Mehta Bull Run for investors in Rajkot?

Some key lessons include the importance of robust regulatory oversight, risk management through portfolio diversification, emphasis on transparency and accountability in financial transactions, and the adoption of long-term investment strategies rather than seeking quick gains.

5. How does the Harshad Mehta Bull Run continue to influence Rajkot’s financial landscape today?

The Harshad Mehta Bull Run serves as a cautionary tale, reminding investors and regulators of the need for vigilance and responsible financial practices. Rajkot’s financial institutions continue to prioritize transparency and accountability, ensuring that the city’s financial scene remains secure and promising for investors.