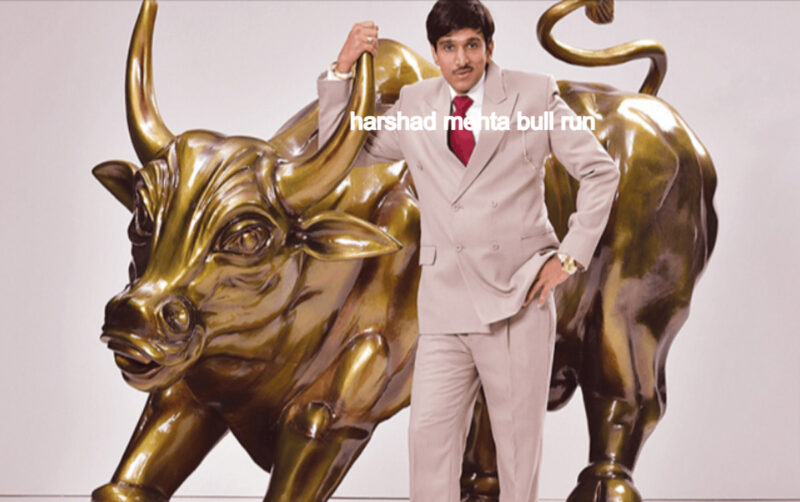

harshad-mehta-bull-run rajkotupdates.news: It is true that the Indian equity market experienced several booms and busts over its past but none quite so dramatic and infamous as those of Harshad Mehta bull run in the 1990s’ early days. Harshad Mehta was a stockbroker from Bombay, and was a household face in Dalal Street during that period because the broker orchestrated a huge rise in the share price which made him as well as his clients wealthy during the process.

But his meteoric rise was followed by a dramatic drop, as his identity was discovered as the chief of one of the largest frauds on the financial sector in Indian history. It involved manipulation of bank receipts as well as siphoning funds from banks to fund his speculation bets.

In this blog we’ll explore the Harshad Mehta bull market and how it came about and what loopholes that led to it, the repercussions and lessons from the experience and how it compares with the current market conditions.

Also Read: rajkotupdates.news/the-us-is-on-track-to-grant-more-than-1-million-visas-to-indians-this-year

What made Harshad Mehta end up becoming known as the Big Bull?

Harshad Mehta, born the 29th of July 1954, in Paneli Moti, Rajkot district and was a member of the Gujarati Jain family. His childhood was spent in Borivali in the city where his dad was a part-time textile businessman. He earned his B.Com in 1976 at Lala Lajpatrai College, Bombay and was employed in a variety of odd jobs over the next 8 years, such as the sale of hosiery and cement or sorting and separating diamonds. He began the career of a salesperson at the Mumbai office of the New India Assurance Company Limited (NIACL).

In the beginning of the 1980s, He was offered a lower-level clerical position in the firm of brokerage Harjivandas Nemidas Securities where he worked as a jobber to his broker Prasann Pranjivandas Broker, who was considered to be as his “Guru”. For a total of ten years, starting in with the year 1980, he held posts of increasing responsibility in several brokerage firms. In 1990, he had gained importance within the Indian sector of securities and journalists (including popular magazines like Business Today) touting him as the “Amitabh Bachchan from the stock market”. He founded his own firm, Grow More Research and Asset Management and enlisted the financial aid of his associates, after the BSE auctioned a broker’s account.

In the early 1990s the eminent individuals began investing in his company, and use his services. He was able to maintain a loyal base of investors who relied on his recommendations and stock picks. Additionally, he had access sums of money from financial institutions and banks via a complex web of transactions that involved banks’ receipts (BRs). They were utilized in short-term bank-to-bank lending known by the name of “ready forward” transactions which Mehta’s business was able to broker. These transactions were intended to be secured by federal securities, however Mehta discovered a way to circumvent this requirement by making fake or forgery BRs issued by cooperative banks and small banks that didn’t possess any government securities to lend. The funds were then used to purchase large amounts of shares in selected companies, creating an artificial demand, which drove up the prices of their shares. He also propagated rumors and positive information about these companies in order to draw more buyers and increase their valuations.

In doing so the entrepreneur created an unprecedented bull run in the market for stocks which lasted from 1990 until 1992. In the year 1990, the BSE Sensex rose from around 800 points in January 1990, to more than 4500 points in April of 1992 which was a rise of more than 450 percent. Mehta’s personal wealth also increased and he showed it off with extravagant automobiles, bungalows, and even jewelry. He was seen as a hero, and a genius by investors who made massive profits through his advice. He also enjoyed the support of politicians and influence and was often seen in the company of business people and celebrities.

What was the method by which this Harshad Mehta scam discovered?

The Harshad Mehta scam was exposed through an array of incidents that began in the month of April, 1992. The main reason was the tightening of cash supply at the Reserve Bank of India (RBI) to stop inflation. This made it more difficult for Mehta to obtain money from banks to keep his spending spree going. Also, he was faced with brokerage calls to discuss margins when the prices of stocks began to drop.

The other reason was the discovery of a 600-crore fraud in the State Bank of India (SBI) which involved the transfer of funds from the department of securities to Mehta’s account. This was accomplished by distributing false BRs to Mehta in exchange for checks drawn against his account at Bank of Karad (BOK) which is a small cooperative bank. The checks were not cleared and the BRs weren’t secured by any securities issued by the government. The scam was discovered after the RBI requested SBI to check its BR transactions and discovered they were fake. The RBI also found out it was true that BOK has issued BRs that were worth more than Rs 1200 crores to Mehta without collateral.

The third factor was the expose from reporter Sucheta Dalal of The Times of India, who revealed the truth about how Mehta had played with the market through BRs and diverted cash out of the bank system. She also exposed how he used bribes to pay officials at banks and politicians to help facilitate his scheme.

The fourth reason was the confession of Mehta himself who confessed to his involvement in the fraud during a press conference held on April 23, 1992. He stated that the actions he took were not illegal, and only used weaknesses in the system. He also accused other industrialists, bankers, brokers and politicians of having been involved in the fraud and listed a few of them. He stated that he was willing to cooperate with authorities and return the funds that he took from banks.

What were the results and lessons that were learned in the Harshad Mehta fraud?

The Harshad Mehta fraud had an enormous impact on the Indian society and economy. The negative outcomes and lessons from it include:

- The market plummeted because investors lost faith and trust of the financial system. In the BSE Sensex plunged from over 4500 points in April of 1992 to below 2500 points by August 1992, which was a loss of more than 40%. Many people lost savings as well as their even their livelihoods and some even took their own lives.

- The banking industry was hit hard as numerous banks suffered losses as a result of the risk of being affected by Mehta’s scam. The RBI had to help certain banks through providing liquidity assistance as well as restructuring debts. The credibility and image that the system of banks had was badly damaged.

- The government was in the midst of an unpopularity crisis when government officials and ministers were accused of having been involved or a part of the fraud. The former Prime Minister P.V. Narasimha Rao’s government escaped an unpopular no-confidence motion with an extremely narrow percentage in July. A number of investigations and inquiries were initiated by various authorities, including CBI, JPC CBI, JPC, CAG and so on. However, none of them were able to definitively determine the extent or nature of the political involvement in the fraud.

- The regulation framework that governs the market for securities was overhauled and strengthened to stop frauds from recurring. In the end, the Securities and Exchange Board of India (SEBI) was granted greater authority and power to supervise and regulate market participants and their activities. The new rules and guidelines were introduced to increase transparency accountability, the accountability of disclosure, accountability governance, risk management, and so on. in the market for securities.

- The awareness of the public and knowledge about the stock market has increased because people understood the importance of being aware of their finances and conducting due diligence prior to making a decision to invest their money. Many investors were increasingly cautious of believing in rumors or advice blindly and sought out professional advice or research prior to making investments.

What does the Harshad Mehta bull run compare with the current market situation?

The current market situation in India is very unlike that of the Harshad Mehta bull run in the 1990s in terms of the forces that drive the performance of the market and the regulatory environment and the behavior of investors. One of the major variations are:

- The market’s current rally is fueled by a mix of elements like high business earnings, a recovery in the economy global liquidity, optimism about vaccines policies, etc. instead of manipulating or committing fraud by an individual or a group of people. The market’s breadth and depth are much greater, thanks to participation from a broad group of investors, industries and businesses.

- The regulatory framework currently in place for the market of securities is more secure and efficient as it has SEBI taking an active part in ensuring compliance, preventing malpractices from occurring, safeguarding the interests of investors, and encouraging market development. Technology and digital platforms has improved the efficiency, transparency and access to the market.

- The present investor behaviour is more rational and informed with a focus on valuation, fundamentals diversification, the long-term perspective of investing. Investors are also aware of the potential risks and benefits that investing in stock markets and have access to a myriad of options for education, information and direction.

However, this doesn’t suggest that the current market environment is without dangers or challenges. Some of the threats that could impede the current market rally include:

- The volatility and uncertainty result from the COVID-19 epidemic and its effect on the economic and health condition of the nation as well as the rest of the world.

- The rising inflationary pressures and the rising prices for commodities could impact the growth and profitability of various industries and businesses.

- The tensions in the geopolitical world and trade disputes can disrupt global flow of investment and trade and impact the mood as well as the stability of markets.

- The changes in the regulatory framework and the policy interventions could result in negative or unintended consequences on the functioning of markets or performance.

Therefore, it is crucial for investors to be cautious and prudent when making investments in stocks and not be carried away by fear or greed. Also, they must adhere to basic rules, like:

- Conduct your own analysis and research prior to investing in any investment or scheme. Do not trust rumors or tips from unreliable sources.

- Make sure you invest only in firms that have sound basic principles, strong management, good governance and long-term growth potential.

- Diversify your portfolio over diverse segments, sectors geographical regions, asset classes to limit the risk of your portfolio and increase your return.

- Set a specific investment goal and a strategy, horizon as well as a plan to adhere to it no matter what fluctuations in the market or any background noise.

- Check your portfolio regularly and adjust it in line with your needs and goals, changing needs as well as your risk tolerance and market conditions.

The Harshad Mehta bull race was an historic occasion that was able to teach us a lot of important lessons about the market for stocks. It also demonstrated how one man’s greed and deceit could have a profound impact on the economy and the society. Through the lessons learned from this episode and avoiding repeating the same mistakes again in the future as well as make smarter investment choices for our own country and ourselves.